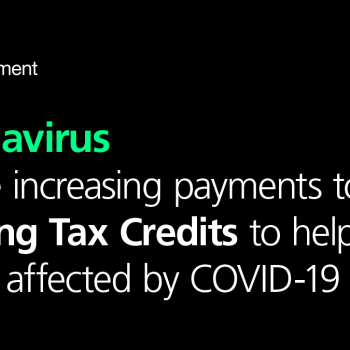

Increase to Working Tax Credits – what this means

The government has announced that Working Tax Credits payments will be increased from 6 April 2020 – find out what’s happening and who this affects.

As part of a number of measures to support the country during the coronavirus (COVID-19) pandemic, the basic element of Working Tax Credit has been increased by £1,045 to £3,040 from 6 April 2020 until 5 April 2021.

The amount a claimant or household will benefit from will depend on their circumstances, including their level of household income. But the increase could mean up to an extra £20 each week.

The government is also updating Child Benefit, other tax credits rates and thresholds, and Guardian’s Allowance by 1.7% with effect from 6 April 2020. You can read the full list of Rates and Allowances.

These increases came into effect on the 6 April, but individual payment dates will vary depending on circumstances.

You don’t have to take any action and you will receive any increased payments automatically.

Use the tax credits calculator to get an estimate of how much you could get in tax credits in a 4-week period.

Source: https://www.gov.uk/government/news/increase-to-working-tax-credits-what-this-means